The 10 stocks leading insider buying in 2022 (and the biggest sellers)

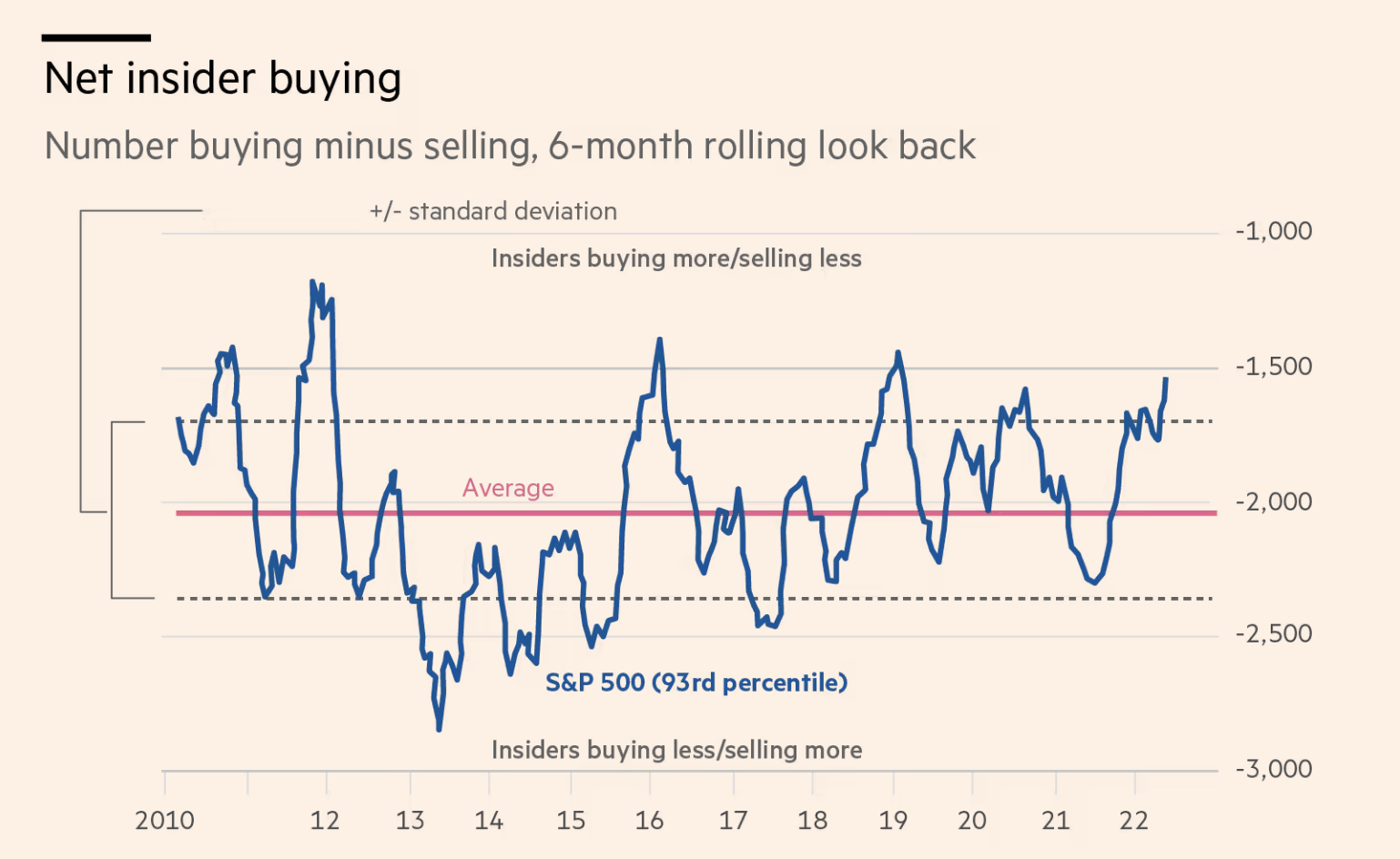

Investors scrambling to identify the potential signs of a reversal is a common feature of every bear market. While there is no foolproof indicator, a glance at what the insiders are doing will often provide early insights.

Across May, US executives purchased stock at levels "not seen since the early days of the COVID-19 pandemic" - a point that marked the start of an incredible bull-run. The confidence we're seeing from those with their fingers on the pulse of business activity is certainly promising, though there's been no immediate response from the market.

"Corporate insiders are holding a non-consensus view across most sectors and [are] actively buying the dip...the share purchases are encouraging for the direction of stock markets." Financial Times

In a recent article, Fidelity International's Tom Stevenson detailed a four-point checklist he uses when analysing recent insider purchasing.

- Make sure the data is not being distorted by big but unusual trades

- Look at the size of the trade

- Consider who is buying

-

Analyse the broader context

Investors tend to consider how much of a company is owned by insiders. Usually, the higher the level of insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Considering the directional trends of this ownership is equally telling.

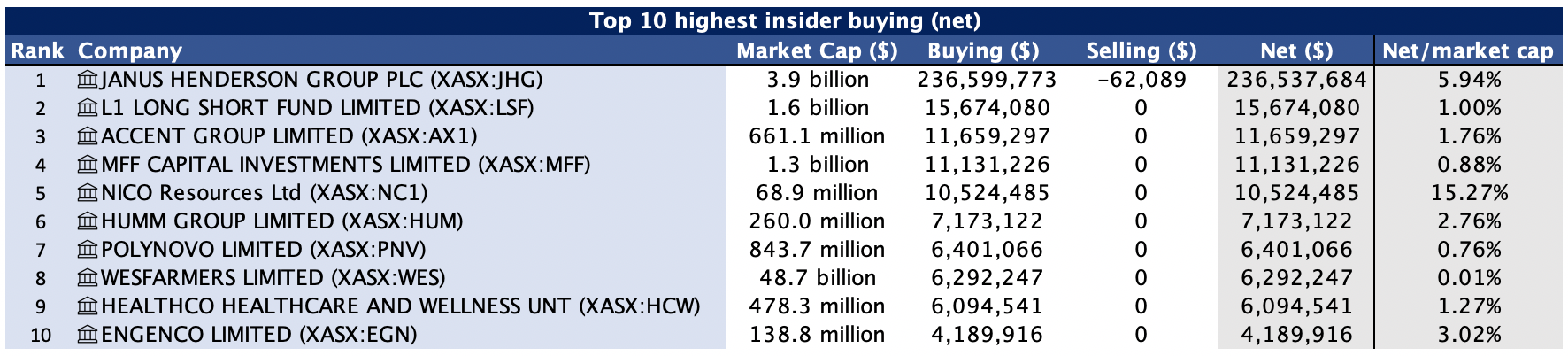

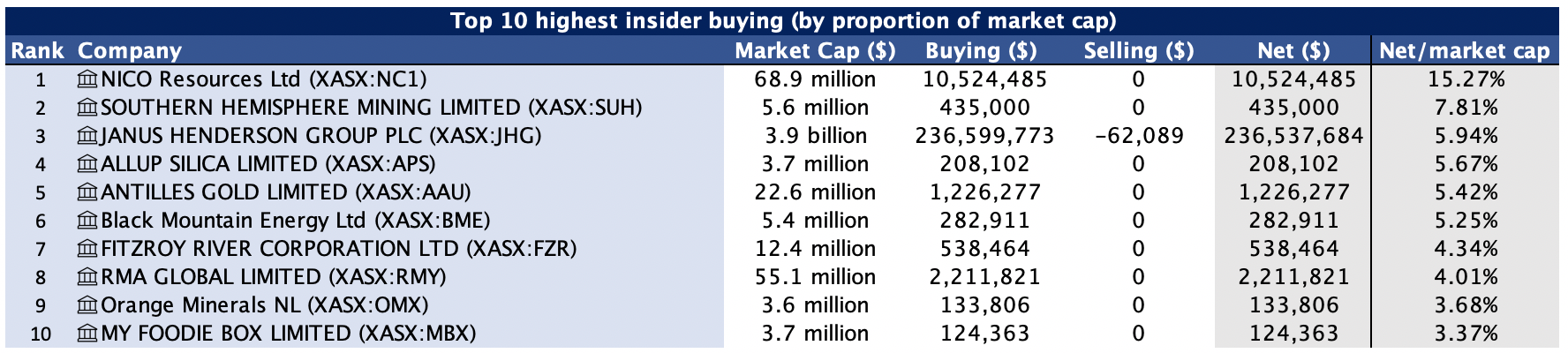

Some of the ASX stocks with the highest levels of insider buying activity are revealed in the following wire, which also details those with the largest sell-downs. The volumes of insider transactions have been analysed, and additionally weighted by market capitalisation so you can see how significant it really is in the broader company context.

Note: We have focused on on-market trades only, excluding off-market transfers, share issues, employee shares, conversions, remuneration and the like. All figures quoted are in the dollar value of the transaction (on market price times quantity bought), which will thus depend on the price of the stock at a particular moment in time.

Most popular stocks among insiders

When we look at the list of the most popular stocks for directors to buy, it is a mixed bag of large and small caps across a broad range of industries.

The number #1 pick: Janus Henderson Group (ASX: JHG)

With nearly 10-times the net buying volume of the next company in this list, the British-American global asset manager was the leader by a country mile. Janus Henderson Group's directors purchased a resounding $236 million worth of stock since the start of the year. This was predominantly done during February and March, and while the stock has fallen more than 25% since then, the directors seem confident a recovery is on the horizon.

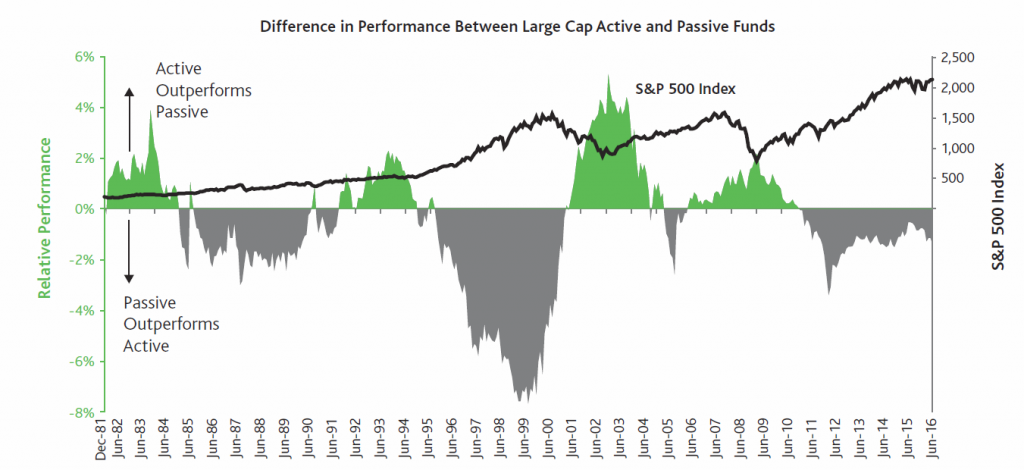

The funds management industry bore the brunt of a pending bear market as equities were punished after a record bull run. But the fact that active strategies tend to outperform passive funds during a recession runs strongly in their favour. This comes down to the importance of risk management and being able to react quickly as reversals trigger opportunities.

Admittedly, the view of active versus passive is riddled with conditional variables, such as the:

- time horizon used,

- type of strategy, and

- tendency for the worst-performing funds to exit the market during recessions.

But even so, there's empirical evidence that suggests active managers are the best approach for wade back into markets after periods of instability, offering a positive catalyst for fund managers over the next couple of uncertain months.

Following along the theme of funds management, we saw the L1 Long Short Fund Limited (ASX: LSF) and MFF Capital Investments (ASX: MFF) both receiving a significant amount of internal attention from their directors. A key screening metric often used for evaluating a fund manager is how much "skin in the game" they have. In this case, all of these three funds certainly tick that box.

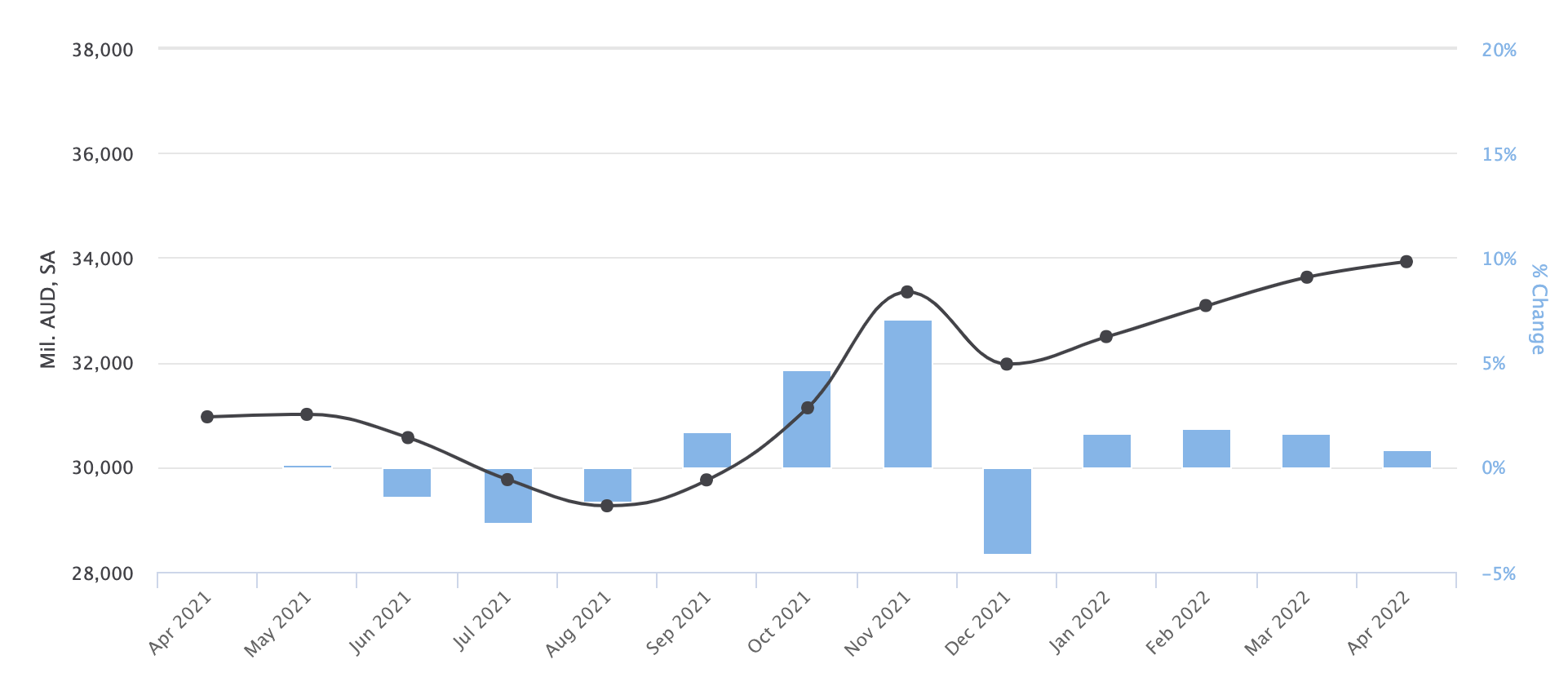

Retailers are also in the crosshairs

Accent Group (owner of The Athlete's Foot, Hype DC, Platypus Shoes, Skechers, Vans, Dr. Martens, Timberland) and Wesfarmers (Bunnings, K-mart, Officeworks among others) were also in the top 10 of net buyers.

Citi's analysts noted that "fewer lockdowns should mean the sustainable return of brick and mortar retail (although foot traffic has stalled)." While consumer confidence has moved in the opposite direction to retail sales, they are confident that the strength of consumers (from strong employment levels) will offset this.

It appears that the insiders of Wesfarmers and Accent Group too are confident in the continued recovery of consumer habits - even with rampant inflation on the horizon.

Similar catalysts could be linked to Humm group - although this example shows how important it is to understand what all insiders are thinking. Founder and director Andrew Abercrombie has been buying up stock since the start of June to consolidate his control over the company. This was in the context of an attempted sale of the company to Latitude - a proposition that Abercrombie "vehemently opposed." In response to the blocked sale, five of the company’s 6-person board stepped down and purportedly refuse to work with Abercrombie.

Insider buying can be a positive sign - but understanding the context of this is crucial.

Scaling our results

In order to put results into a comparable context, we also ranked these stocks on their net transactions as a proportion of market cap. We saw only two companies make a re-appearance: Nico Resources (ASX: NC1) and Janus Henderson Group (ASX: JHG).

Dominated on debut; head remains above water: Nico Resources

Nico Resources (Nickel Cobalt) made headlines in January this year after it surged 82% from a 20-cent offer price on its first day of trading. The stock is a spin-off from Metals X (ASX: MLX)'s nickel and cobalt division. Year-to-date, it is up over 260% from its issue price - making it an outlier given the shakey IPO climate.

.jpg)

Nico's flagship Wingellina Nickel-Cobalt Project is the "largest undeveloped nickel-cobalt project in Australia," hosting an estimated 1.56 million tonnes of nickel and 123,000 tonnes of cobalt.

But why is nickel in high demand? The metal is a key component within lithium-ion batteries, notably those used in electric vehicles. It allows producers to host more energy in their batteries. Cobalt is also a primary input for batteries but is more expensive and has a supply chain that is less transparent than that of nickel - which isn't necessarily a bad thing for a producer like Nico.

"The board believes that with the increasing demand for both nickel and cobalt associated with the battery minerals sector requires a substantial increase in environmentally and ethically sustainable nickel production. Nico Resources is well placed to be able to partner with some of the largest end-users in the world to create a long term supply option for the rapidly growing electric vehicle sector.” - Nico Managing Director and CEO Rob Corps

In this case, management appears almost convinced the projects will yield high outputs. It's also interesting to note all transactions were from CEO Rob Corps (quoted above), who made purchases accross March, April and May. But it is not a repeat of the "buying out of spite" situation we saw at consumer lending and payments company Humm, as Corps and the other two directors remain tied to the firm.

Insiders confident in exploration prospects

The majority of stocks, when weighted by market capitalisation, fell into the smaller commodity and exploration-focused companies:

- Southern Hemisphere Mining (ASX: SUH): Copper-gold explorer with a substantial copper resource based in Chile.

- Allup Silica (ASX: APS): Silica exploration company focused on the development of silica sand tenements in order to achieve a commercial product. Silica is a key input of solar panels.

- Antilles Gold (ASX: AAU): Gold explorer accross the Caribbean, which has a joint venture with Cuba's state-owned explorer GeoMinera SA. Its flagship project is currently in the predevelopment phase, with a Definitive Feasibility Study for the first stage open pit operation by Q4 2022.

- Orange Minerals (ASX: OMX): Another gold and copper exploration company, OMX's projects span the historic Lachlan Fold Belt in New South Wales and the Eastern Goldfields in Western Australia.

- Black Mountain Energy (ASX: BME): Upstream oil and gas company aimed at developing and operating projects in unconventional, hydro-carbon-rich basins.

- Fitzroy River Corporation (ASX: FZR): Makes non-operational investments in oil and gas production, FZR's investments revolve around Royalty interests accross permits based in the Canning Basin, Western Australia.

Strong insider buying in this stock sub-sector suggests conviction in the asset these companies are developing, whether that is confidence in its feasibility, or a bullish perspective on future prices of the specific commodity involved.

Market cap a core outlier

A key highlight is the average market capitalisation of this list - $416 million (and a mere $22 million if you exclude the outlier that is JHG). This is a huge drop-off from the average of $5.8 billion from the previous list (this time affected by the huge impact of Wesfarmers). While this is not an obvious apples-for-apples comparison, it demonstrates the impact and significance of insider buying at the small and micro end of the market.

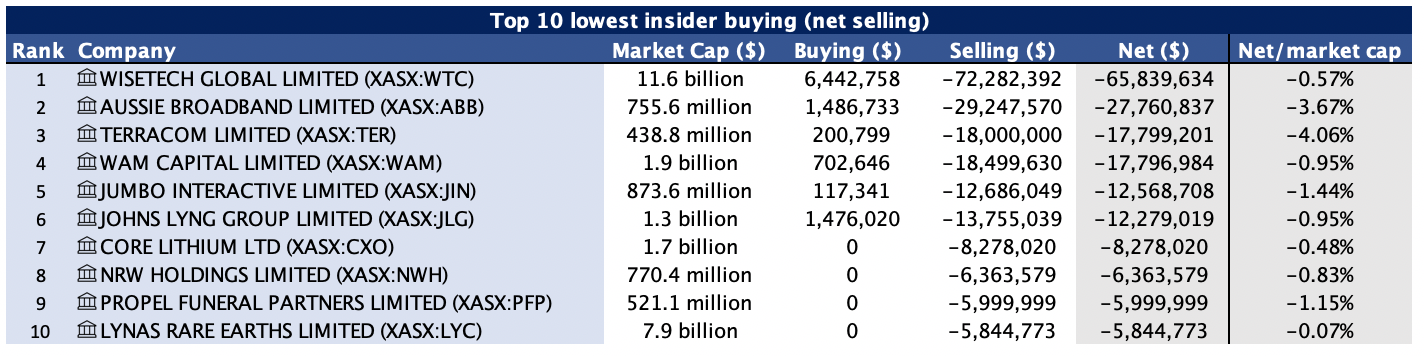

The least popular stocks among insiders

We then turned our analysis to the pessimistic side - the stocks that have the highest net levels of insider selling. And when ranking by magnitude, there were a number of familiar names that popped up.

What the billionaire isn't investing in

In 2021, the AFR named Richard White, the CEO of logistics software firm Wisetech (ASX: WTC) as the wealthiest executive on the ASX300. In 2022, his position was consolidated as he placed 14th on the AFR's annual Rich List with a humble $6.33 billion.

The investments of this cohort can be a great source of new ideas – we're guilty of the occasional snoop here at Livewire.

But in this case, it is more interesting to note what White is avoiding, as he continues to liquidate his WiseTech shareholding. He has been gradually selling down his 44% stake in order to "diversify his assets and the shareholder base of his company."

In 2020, the company was targeted by short-sellers, who labelled a flurry of acquisition activity as simply a way for executives to sell down their stakes:

"Short sellers argue the acquisitive strategy has helped the founder repeatedly sell down his stake in the business to new investors, while selling overvalued equity to pay for acquisitions that disguise the group's true growth rates. Mr White has always strongly denied this argument, and his recent share sales just before the end of financial year could be for any number of personal reasons." - Australian Financial Review, June 2020

Ultimately, White has been consistently selling down his shares over the past two years. In that time, WiseTech has continued to grow and deliver positive returns (albeit with some major turbulence), especially given the focus on global logistics as supply chains everywhere are stretched. A positive sign is that White remains highly invested in the company, but it will be interesting to monitor the rate of change in his selling as we enter a volatile bear market.

Big companies, big levels of selling

Four other companies on this list have market caps north of $1 billion.

WAM Capital (ASX: WAM) - The Wilson Asset Management operated LIC - runs an investment portfolio focused on undervalued growth companies. Founder and Chairman Geoff Wilson sold $842,682 of WAM shares over four transactions in March and April this year when the LIC was trading at a ~30% premium to NTA. More recently, Wilson has bought back $702,646 worth of WAM shares in a series of transactions throughout May.

WAM Capital's acquisition of Westoz (WIC) and Ozgrowth (OZG) also saw new Change in Directors Interest notices being lodged in Geoff Wilson's name. A representative of Wilson Asset Management provided the following explanation.

"When WAM acquired WIC and OZG through the Schemes of Arrangement on 21 April, WAM Strategic Value (ASX: WAR) received new WAM shares as part of the mergers for the WIC and OZG shares that it had held prior to the announcement of the mergers last year. The shares that WAR received in WAM as part of the mergers in April were subsequently sold by WAR for approximately $17m; they were not shares that Geoff Wilson held directly in his name. As Geoff is a director of both WAM and WAR, the new shares that WAR received in WAM as part of the mergers were required to be disclosed in his individual directors interest notice (Appendix 3Y) for the indirect holding.”

Also of note is the fact that Wilson has been buying up shares in Future Generation Investments (ASX: FGX), his own charitable investment initiative LIC. He has secured an additional $450,000 of stock over April and May.

Johns Lyng Group (ASX: JLG) - Despite being a massive beneficiary of continued public investment in infrastructure and construction, this building services company has seen executives reduce their holdings recently. Scott Didier (CEO) and Lindsay Barber (COO) each sold 1 million shares in late May. Both remain significantly invested in the company though - a positive sign - with post-sale holdings of 20.6% and 4.95% respectively.

As is industry standard, the rationale given was that this was done to "manage personal asset portfolios." Markets did not completely appreciate this, the share price falling 4.3% in response.

Core Lithium (ASX: CXO) - The key lithium producer took a beating last week after German finance minister Christian Lindner "rejected EU plans for a de facto ban on the sale of new combustion engines cars by 2035." This triggered a sell-off accross lithium producers, but they have since rallied. Arden Jennings recently pointed them out as a "top stock powering the future of the energy transition in the small-cap space", however there remains uncertainty about the future direction of the commodity's prices among analysts.

"The battery metals bull market has peaked" - Goldman Sachs, May 2022

There is once again a unique driver of selling here, with all sales coming from Managing Director Stephen Biggins following the announcement of his resignation. The rest of management appears to be holding onto their stakes at the current moment

Lynas recently secured a $US120 million contract to build a processing facility in the US in partnership with the US Department of Defence. The facility (will) provide the US with access to a supply of the critical minerals essential for manufacturing a range of military tools, electric vehicles and wind turbines. The market is currently dominated by Chinese suppliers which heightens the risk of supply disruptions at critical times. - James Gerrish

Again, all of the sales accross 2022 have come from one executive, this time CEO Amanda Lacaze in March. She made a similar move in February 2021 in order to "satisfy taxation liabilites".

However what differentiates Lynas from some of the other stocks on this list is a measly level of insider ownership - only 0.97% of the firm is owned by insiders.

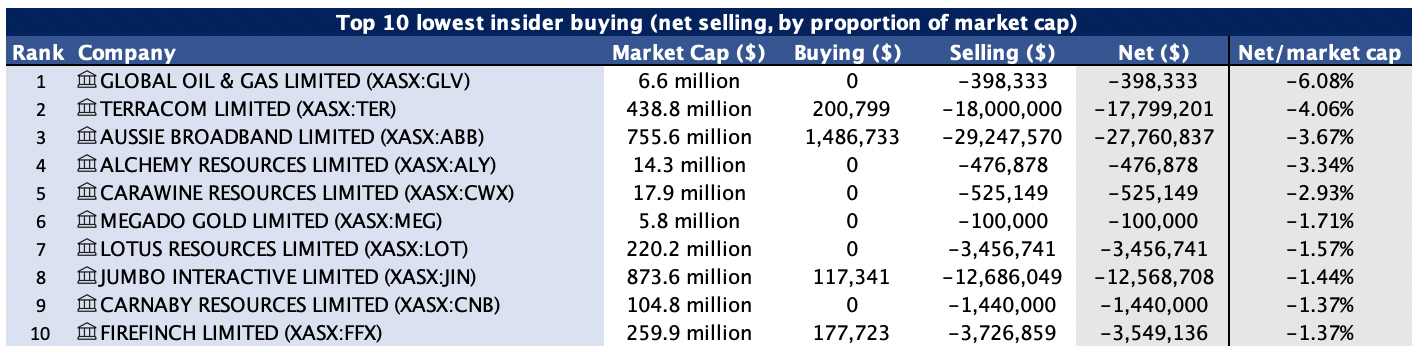

Scaling net-selling results

In terms of the largest net sellers by market capitalisation, it again is heavily concentrated at the smaller end of the market.

Conclusion

From these lists, there is evidently a wide spread of stocks from a breadth of industries included. This exercise has revealed the importance of looking beyond the numbers when it comes to making decisions about these stocks. While there may be short-term trading opportunities, if you are considering longer-term investments, understanding the narrative and rate of change of insider transactions is crucial. Each decision has a different context behind it, whether that is Humm's board dispute or WiseTech's history of predictable selling.

Again, utilising a checklist (such as the one flagged at the beginning of the article) provides a sound foundation of the key factors to look into.

To end on a Peter Lynch quote:

"Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

Want more lists of fascinating stocks? Check out some themes that have interested our readership lately:

.png)

.jpg)

.png)

Never miss an insight

If you liked this wire, make sure to hit the like button.

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

5 topics

35 stocks mentioned

6 contributors mentioned